UNITED STATES

PRICE OF DOMESTIC AND IMPORTED LIGHT HONEY FROM ARGENTINA IN JUNE 2023 AND JUNE 2024

July 29th, 2024

Versión original en Castellano

Versión original en Castellano (Espacio Apícola - July 29, 2024) The United States Department of Agriculture published the honey market report for June 2024 in that country last Friday, July 26.

(Espacio Apícola - July 29, 2024) The United States Department of Agriculture published the honey market report for June 2024 in that country last Friday, July 26.The price paid for honey from Argentina has increased slightly in the second quarter of the year. After a catastrophic February where white honeys reached an average of just over 2,320 dollars per metric ton, in what we believe was the end of a negative slope that prevailed throughout 2023 (see Espacio Apícola 142) and after a month of March with a very significant increase in price, particularly for white honeys, between April and June all categories of honey imported from Argentina into the United States were adjusted upwards: white honey, extra light amber honey, light amber honey and amber honey, according to the commercial segmentation of the traditional 140 mm colorimetric scale, Pfund scale.

The price of white honeys increased by 10% between April and June; Extra light amber honeys fluctuated around USD 2,400 per metric tonne in the quarter; light amber honeys, which are below 85 mm Pfund, exceeded USD 2,200 per metric tonne, being the ones that increased the most in relation to April, and amber and darker honeys, from 85 mm Pfund onwards, had an improvement between 5 and 7% averaging USD 1,770 in the month of June.

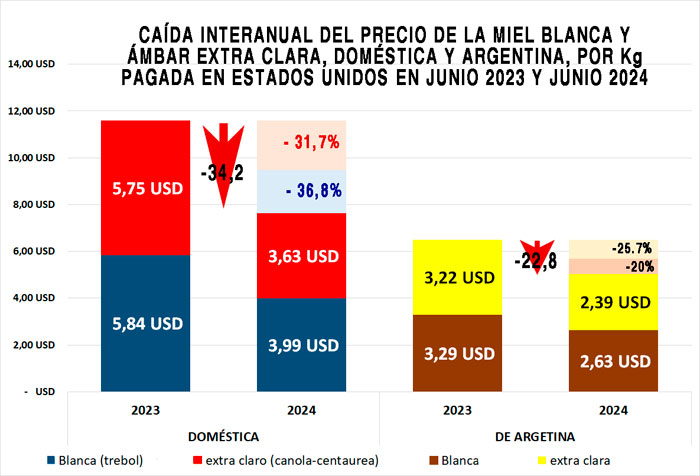

In the market segment where main Argentine honeys are and compete directly with the main table honeys produced by American beekeepers there is a worrying drop in price mainly for North American producers. As we can see in the graph, from June 2023 to June 2024, honeys below 50 mm Pfund, white and extra-light amber, lost more than a third of their value for honey produced in the United States and an average of 23% for honeys purchased from Argentina. In the case of the United States, we take as a reference the prices of the emblematic clover honey, as white honey, and for extra-light amber honeys, some canola or knapweed honeys (a Centaurea). In the reports from US customs, honeys imported from Argentina are only reported by color.

The pressure on the prices of Argentine honey is partly understood by the anti-dumping sanctions imposed by the United States. This pressure should benefit the purchase of local honey; however, the sanctions for dumping were not equivalent against honey from other countries that have begun to sell in the same segment of light honeys, added to others that traditionally did not sell honey to the United States and some that enter this segment of table honeys with organic certification with lower relative prices than conventional honey from Argentina and in enough volume to generate an impact.

Thus, comparing the information provided by the reports of the United States Department of Agriculture, the estimated average price of white honeys (particularly clover honey) paid in that country to beekeepers was 5,840 USD per metric ton in June 2023, while in June 2024 it fell to 3,990 USD per metric ton, 31.70% less. For its part, extra-light amber honeys (canola or knapweed honeys) fell, in the same period from 5750 USD per metric ton to 3630 USD, a drop of 36.78%, which, taking a general average, adding both categories, gives an average price drop of 34.22%.

In the same period and from the same source of information, white honey purchased from Argentina fell from 3290 USD/t in June 2023 to 2630 USD in June 2024, a drop of 20%; while the price paid for extra-light amber honeys from Argentina fell from 3220 USD/t to 2390 USD as shown in the attached graph, both averaging a drop of 22.78%.

For their part, countries that benefited from the United States Department of Commerce's determinations with low or zero tariffs after the Dumping Investigation Period (POI) increased their prices, although always significantly below the prices received by local producers.

When the Sioux Honey Association and the American Honey Producers Association of the United States requested anti-dumping actions against honey from China and Argentina in 2000, the DOC's determinations forced Chinese honey out of the market with a tariff of over 200%, and while the sanctions against Argentine honey were, on average, 42.41% (36.56 for dumping and 5.85 for countervailing duties, see Espacio Apícola, No. 132, citing issues 45 to 49 between 2000 and 2001), Argentina's economic downturn in 2002 reduced honey sales to the United States, where demand for honey was growing and world suppliers of light honey were scarce. This raised prices for beekeepers in Argentina and the United States and opened the market to Brazilian companies (Espacio Apícola No. 140). The current scenario is completely different for both Argentines who have suffered fraud by their own State against honey exports, which worsened in the last year of the outgoing administration in 2023, and for American beekeepers who encountered commercial strategies from other supplier countries that twenty-five years ago were not in this market.

In addition to this challenge, the marketing of Argentine honey and that of American beekeepers face the opening of that market to honey suspected of fraud and honey with dubious quality certifications, which may well threaten the confidence of the American consumer, as would be happening with the European consumer, where consumption of honey and especially organic honey has fallen by more than 24% (Espacio Apícola No. 143 citing reports from the EU 2024 and Nielsen Consumer 2023).

In this context, it would be desirable for the FDA to reinstate in the United States the publication of Import Alert No. 36, with the red list of honey exporting companies suspected of fraud, which was surprisingly suspended after the efforts made by the "US Pharmacopeia" to determine standards for honey and after the publication in India of the "China trail" where the technological and commercial machinery of honey substitute products that are marketed worldwide as such was made evident (Espacio Apícola 131).

Fernando L. Esteban

apicultura.ar

Information generated by "Espacio Apícola" the Argentine Beekeepers' Magazine apicultura.com.ar